Estate Valuation: Determining Property & Asset Worth

Estate valuation is one of the most crucial steps in managing a person’s belongings after they pass away or when preparing to downsize, liquidate assets, or transfer property.

From real estate and vehicles to jewelry, antiques, and collectibles, every piece of property holds value—and determining that value accurately requires careful assessment, documentation, and expertise.

Estate valuation ensures transparency, fairness, and legal compliance, especially during probate, estate sales, divorce settlements, or wealth planning.

Whether a family is navigating a stressful transition or planning ahead, understanding how estate valuation works helps protect what matters most.

This is where professional Estate Valuation, asset appraisal services, and probate valuation experts become essential.

What Is Estate Valuation?

Estate valuation is the process of determining the fair market value of all assets owned by an individual at a specific point in time.

These assets can include:

- Real estate properties

- Personal belongings (furniture, art, jewelry, vehicles)

- Investments and bank accounts

- Business ownership and intellectual property

- Collectibles and rare items

The purpose of valuation can vary depending on circumstances, such as estate settlement, insurance, sale, taxation, or inheritance distribution.

Accurate valuation ensures assets are measured fairly, preventing disputes among heirs, buyers, or legal entities.

Why Estate Valuation Matters

Properly determining the worth of an estate goes beyond numbers.

It provides:

1. Fair Distribution of Assets

When someone passes away, beneficiaries expect equitable distribution.

A reliable valuation offers clarity so heirs receive property based on real market value rather than assumptions.

2. Probate and Legal Compliance

During probate, courts require documented valuations to verify estate value and tax implications.

Working with probate valuation experts helps ensure legal accuracy and fraud prevention.

3. Reduces Family Conflict

Disagreements can arise when members believe certain assets are undervalued or overvalued.

A neutral, professional appraisal eliminates misunderstandings.

4. Supports Estate Sales

When families decide to liquidate assets through an estate sale, accurate pricing attracts buyers and maximizes revenue.

5. Tax Reporting

Estate valuation also determines tax liabilities on inherited wealth or property transfers.

Overvaluation could mean paying higher taxes, while undervaluation can lead to penalties.

Primary Components of Estate Valuation

Estate valuation is more than a single assessment. It requires in-depth examination of multiple categories:

Real Estate

The home or properties owned by the estate often make up the largest portion of total value.

Professional appraisal determines:

- Market comparables

- Land condition and development potential

- Home upgrades and structural quality

- Property location trends

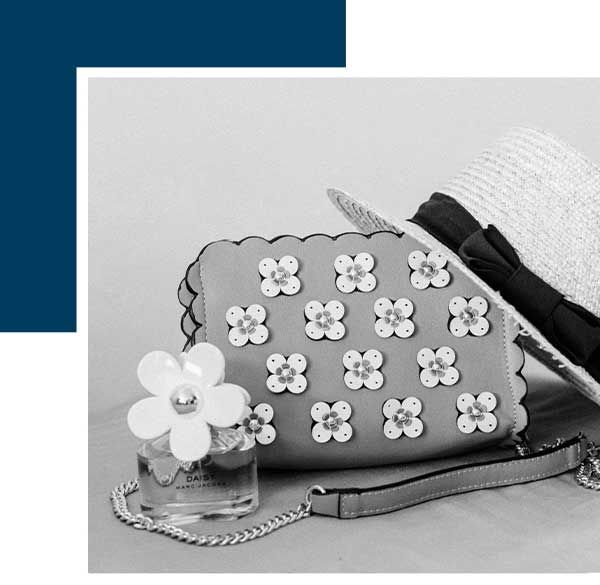

Personal Property

These items can include antiques, luxury brand collections, artwork, designer furniture, jewelry, vehicles, and more.

Specialized asset appraisal services evaluate age, rarity, brand, craftsmanship, and market demand.

Financial Assets

Stocks, bonds, retirement accounts, and investment portfolios require valuation based on market performance and documentation.

Business Interests

If the deceased owned a business, an additional business valuation must be performed, including:

- Annual revenues

- Intellectual property

- Assets and liabilities

- Market competition analysis

Who Conducts Estate Valuations?

Estate valuation requires multiple experts depending on asset type:

Asset Category

Professional Involved

Real estate

Certified property appraisers

Jewelry, art, collectibles

Specialized appraisers

Investments

Financial advisors

Probate processes

Probate valuation experts

Estate sales

Professional estate sale companies

When an estate contains diverse assets, hiring a full-service company helps simplify the process.

The Role of Asset Appraisal Services

Asset appraisal services provide accurate, detailed documentation of an estate’s items.

Appraisers research market trends, authenticate rare assets, and determine realistic selling prices.

These services protect families from undervaluation or opportunistic buyers and support fair estate liquidation strategies.

Key benefits include:

- Professional documentation for legal use

- Reduced stress for families

- Maximum estate sale returns

- Prevents misrepresentation

These services are priceless during probate, inheritance distribution, or preparing an estate sale.

Understanding Probate and Valuation Requirements

Probate is the legal process that confirms a will, identifies assets, pays debts, and distributes what’s left to beneficiaries.

Courts require valuation to ensure assets are accounted for properly.

Probate valuation experts provide:

- Legal paperwork documentation

- Court-ready valuation reports

- Tax compliance guidance

- Inventory and categorization of estate items

Their expertise ensures families meet legal standards without costly mistakes or delays.

How Estate Sales Connect to Valuation

Many families choose an estate sale to liquidate property after valuation is completed.

Accurate pricing ensures everything sells at maximum market value—not too high to discourage buyers, and not too low to lose money.

Estate sale companies manage:

- Pricing and professional valuation

- Marketing and crowd management

- Sale events and negotiations

- Inventory tagging and organization

Working with a reputable company ensures the estate is represented professionally, respectfully, and profitably.

Why Professional Estate Valuation Is Better Than DIY

While families may attempt to price belongings on their own, sentimental value can distort judgment.

Online listings can be inaccurate, and rare items may require authentication.

Professional valuation offers:

- Market-driven accuracy

- Neutral, impartial evaluations

- Authentication and expert pricing

- Legal and tax-ready documentation

In estate planning or management, the cost of mistakes can far exceed the price of professional help.

Estate Valuation With The Perfect Piece Atlanta

At The Perfect Piece Atlanta, valuation and estate transition services are grounded in accuracy, integrity, and compassion.

With decades of experience and a reputation as one of the top estate sale companies in Georgia, families trust our team for expert estate valuation support.

Our mission is simple: to make your transition into the next chapter of life as smooth and stress-free as possible.

Hosting multiple sales each weekend, we’ve grown into one of the largest estate sale companies in the state—ranked among the top 10 most viewed nationally.

Fully insured through Auto-Owners Insurance, we offer peace of mind and professional protection at every step.

With experienced valuators, auction specialists, and probate valuation experts, we ensure every asset in your estate is accurately priced, legally documented, and properly prepared for sale or transfer.

Final Thoughts

Estate valuation is more than determining what something is worth.

It’s about honoring legacies, protecting families, and ensuring fairness.

Whether you’re preparing for the future, managing a loved one’s estate, or planning a liquidating sale, relying on professionals ensures accuracy, legal compliance, and peace of mind.

From personal treasures to financial investments, valuation helps provide clarity during life’s major transitions.

With expert Estate Valuation, trusted asset appraisal services, and knowledgeable probate valuation experts, you can protect assets and make confident decisions—today and for generations ahead.

FAQs

What is estate valuation?

Estate valuation is the process of determining the fair market value of all assets and property owned by an individual. This includes real estate, personal belongings, investments, business interests, and other valuables. Accurate valuation is essential for legal, tax, and estate planning purposes.

Why is estate valuation important?

Estate valuation ensures fair distribution of assets among heirs, helps calculate tax liabilities, supports probate processes, and provides accurate pricing for estate sales. It also minimizes disputes and protects families from financial loss.

Who can perform estate valuation?

Estate valuation should be conducted by professionals such as certified appraisers, financial advisors, and probate valuation experts. Specialized asset appraisal services may be needed for jewelry, artwork, antiques, or rare collectibles.

What is included in an estate valuation?

An estate valuation typically includes:

- Real estate properties (homes, land, commercial property)

- Personal property (furniture, art, jewelry, vehicles)

- Financial assets (bank accounts, investments, stocks)

- Business interests

- Collectibles and rare items

How is real estate valued in an estate?

Real estate is evaluated based on factors like location, property size, condition, market comparables, and recent sales trends. A certified real estate appraiser typically conducts this evaluation to ensure accuracy for probate or sale purposes.

How are personal belongings and collectibles valued?

Specialized appraisers assess items based on condition, authenticity, rarity, brand, and market demand. Asset appraisal services provide detailed documentation to support legal or sale-related decisions.

What role do probate valuation experts play?

Probate valuation experts help families and legal representatives determine the estate’s total value for court proceedings. They provide accurate reports, legal documentation, and tax compliance guidance, ensuring the probate process is smooth and efficient.

Can I value my estate on my own?

While it’s possible to estimate values, DIY assessments often lead to inaccuracies due to sentimental bias or lack of market knowledge. Professional valuation ensures accuracy, legal compliance, and fair market pricing.

How does estate valuation affect taxes?

Estate valuation determines the total worth of an estate, which affects estate taxes, inheritance taxes, and reporting requirements. Under or overvaluation can lead to penalties or missed opportunities for tax optimization.

Why should I hire a professional estate sale company?

A professional estate sale company ensures assets are priced accurately, marketed effectively, and sold efficiently. They coordinate with probate valuation experts and asset appraisal services to maximize returns and minimize stress for the family.

How long does an estate valuation take?

The timeline varies depending on the complexity and size of the estate. Simple estates may take a few days, while larger estates with diverse assets can take several weeks. Working with experienced professionals helps streamline the process.

How much does estate valuation cost?

Costs depend on the size and type of assets, complexity, and the professionals involved. Many estate sale companies or appraisal services offer transparent pricing or flat-fee packages for comprehensive estate valuation.